Best Guide on HRA Exemption – Section 10(13A)

House Rent Allowance (HRA) is an allowance paid by an employer to its employees for covering their house rent. Such allowance is taxable in the hand of the employee. However, Income Tax Act provides a deduction of hra under section 10(13A) subject to certain limits. Self employed individuals are not allowed to take any deduction under this section.

All big companies include a part of salary as HRA as it is a good tool for tax saving by salaried individuals.

Deduction under this section is allowed in same manner for all employee whether central or state government employees or private organisation’s employees.

HRA Deduction Calculation

Use our House Rent Allowance (HRA) Calculator to calculate your annual/monthly exemption available for HRA.

A deduction from such HRA is allowed under section 10(13A), which is least of the following: –

- Actual HRA received

- 40% of salary (50% of the salary if the rented property is in Metro City i.e. Mumbai, Delhi, Chennai or Kolkata)

- Actual rent paid less 10% of salary

Meaning of salary for HRA exemption calculation

- Salary includes basic salary, dearness allowance (if it enters into retirement benefits) and fixed percentage commission on turnover achieved by the employee.

- Salary is taken on the due basis for HRA calculation.

- Salary is taken only for the period for which House Rent Allowance is received.

Conditions to be satisfied for claiming HRA deduction

- This deduction is allowed only when an employee actually pay rent for his residence purpose. If no rent is paid for any period then no deduction is allowed for that period. Rent receipts may be asked as proof by the income tax officer. No documents are required to be attached at time of filing ITR.

- If there is any change in the amount of salary, rent or HRA or city of residence from metro to non-metro or vice versa during the year then such deduction is calculated on monthly basis.

- Even if rent is paid to any family members, HRA is allowed. There is no legal requirement but it is advisable to pay such rent on monthly basis and through bank transfer.

Bajrang Prasad Ramdharani 2013 ITAT. Also keep in mind that such rent paid to a family member is taxable in hands of such member. However he/she gets standard 30% deduction, so you will be in benefit. (Considering the slabs in which you and family member falls)

- There is no requirement that employee should not own a house property. If the employee resides in a rented property, he can claim exemption even if he owns a house property in the same or different city.

- Deduction of house rent allowance, home loan interest under section 24b, repayment of housing loan under section 80C can be claimed simultaneously.

- If an employee receives HRA which is allowed as deductible under this section then no deduction is allowed under section 80GG.

- No deduction is allowed under this section if employee does not receive any house rent allowance from employer. However deduction for rent paid can be claimed under section 80GG.

- If maintenance charges are paid separately then no deduction is available for the maintenance charges.

Want your employer to take HRA deduction into consideration and thus deducting lower TDS

- Form no. 12BB is to be submitted to the employer. If the total rent paid during the year exceeds Rs. 1,00,000 then PAN of the landlord is to be submitted in this form. If there is more than one landlord then details of all landlord are to be submitted. (Income-tax (11th Amendment) Rules, 2016)

- In case the landlord does not have a PAN, a declaration to this effect from the landlord, along with the name and address of the landlord should be given to the employer. (Circular no. 8/2013)

Declaration by House Owner/Landlord if he doesn’t have PAN in Word format

- The employee is exempted from production of rent receipt to the employer, if the house rent allowance is up to Rs.3000/- per month. It may, however, be noted that this concession is only for the purpose of tax-deduction at source, and, in the regular assessment of the employee, the Assessing Officer will be free to make such enquiry as he deems fit for the purpose of satisfying himself that the employee has incurred actual expenditure on payment of rent. (Circular no. 8/2013)

Related Documents

How to Claim HRA in ITR

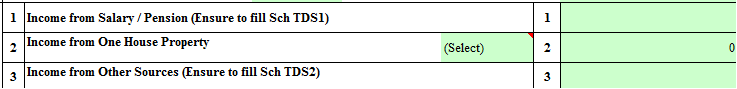

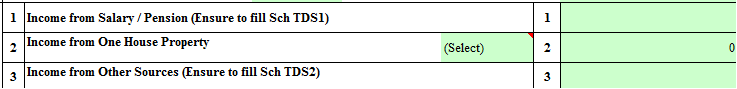

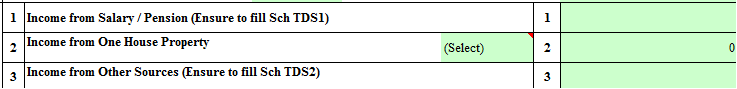

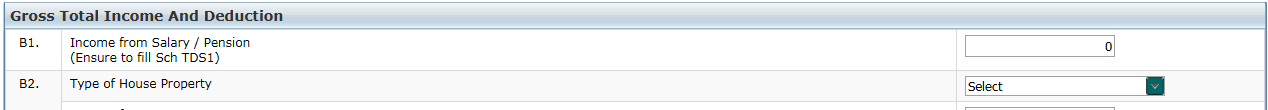

- Filing ITR – 1 – You will have to directly input taxable salary after all deductions in “Income from Salary/Pension”.

Similarly for java utility taxable salary is to be input.

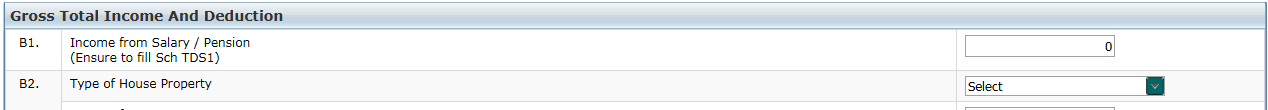

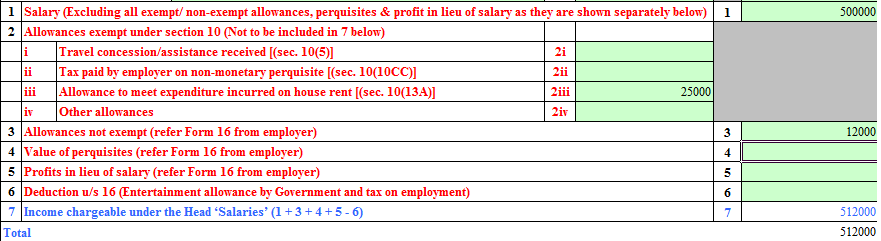

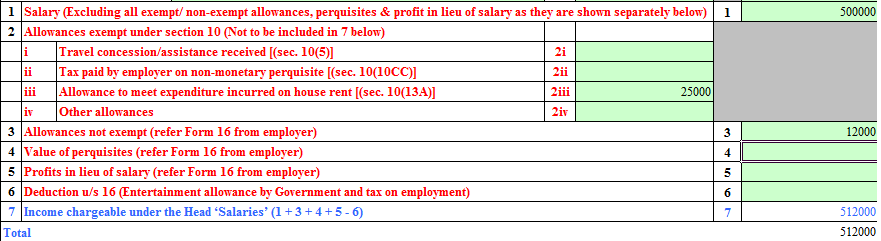

2. Filing ITR – 2, 2A, 3, 4, 4S – In any of these ITR forms you have to use the Schedule S and feed the exempt portion of HRA in point 2(iii) and the taxable portion on point 3 along with other taxable allowances. Also for the java utility the concept is same.

Watch the provisions in this HRA video guide-