While the New Hampshire housing market exhibits signs of resilience and growth, it is imperative to address the underlying challenges of inventory scarcity and affordability. Sustained efforts aimed at expanding housing supply and enhancing affordability measures are crucial for fostering a more inclusive and sustainable real estate landscape in the Granite State.

The housing market in New Hampshire is experiencing a significant surge, with home prices soaring to unprecedented levels. In March, the median sales price of single-family residential homes skyrocketed to $500,000, marking a historic milestone for the state.

This surge in home prices has intensified concerns about affordability, as it represents a 16 percent decrease from the previous year. The New Hampshire Association of REALTORS President, Joanie McIntire, emphasized that the root of the problem lies in the persistent shortage of available housing.

The affordability index, a measure of how feasible it is for median-income households to afford a median-priced home, plummeted to 59 in March. This indicates that the median household income in the state is only 59 percent of what is necessary to qualify for the median-priced home, considering prevailing interest rates. Notably, this is the lowest March number recorded since 2005.

The scarcity of housing inventory continues to be a major contributing factor to the escalating prices. With just 1,228 single-family residential units available for sale by the end of March, there is a stark imbalance between supply and demand. This translates to only 1.3 months of housing supply, far below the five to seven months considered balanced for the market.

McIntire emphasized the urgency for intervention from policy makers at both the local and state levels. She advocated for less restrictive zoning and the removal of unnecessary bureaucratic hurdles to empower property owners.

One legislative initiative addressing these concerns is House Bill 1291, which aims to permit property owners to establish accessory dwelling units (ADUs) attached or detached from the principal residence. McIntire sees this as a step forward in addressing housing shortages.

She questioned the inconsistency in regulations between neighboring towns, where one may allow ADUs for family care while another prohibits it. House Bill 1291 has passed the House of Representatives and is now awaiting a Senate hearing.

Despite the challenges, there are indications of resilience in the market. While March unit sales decreased by 2 percent compared to the previous year, pending sales saw a notable 11 percent increase. This suggests ongoing activity and demand within the market.

The surge in home prices in New Hampshire reflects a complex interplay of factors, including limited inventory, policy constraints, and economic dynamics. Addressing these challenges requires a multifaceted approach involving legislative action, community engagement, and strategic planning.

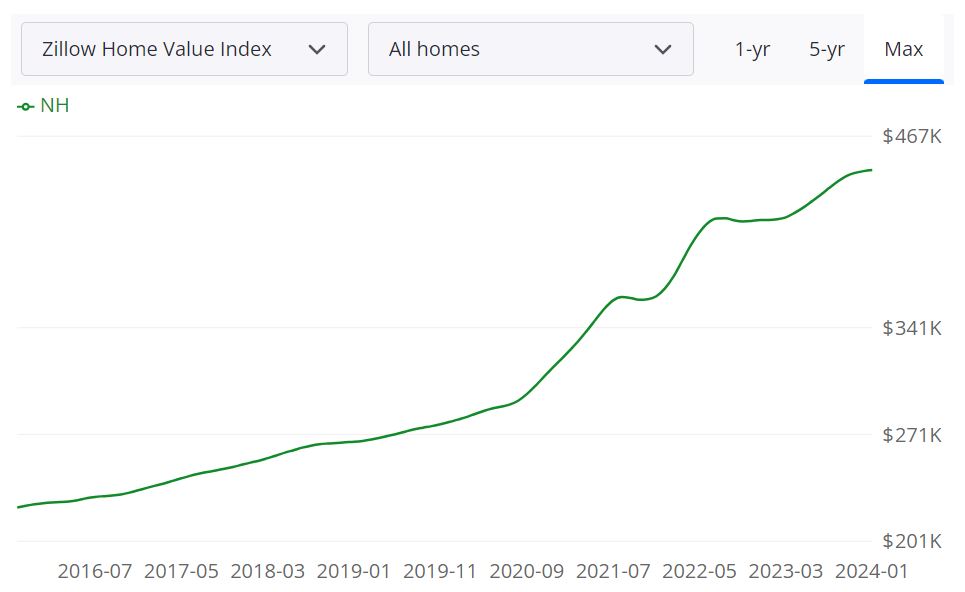

According to Zillow, the average New Hampshire home value stands at $454,948, representing a notable 8.3% increase over the past year. This surge in value indicates a robust market, potentially indicative of high demand and limited supply. Additionally, homes in New Hampshire appear to move swiftly, with the average time to pending being approximately 10 days.

The current state of the housing market in New Hampshire leans towards being a seller's market. This is evident from the relatively low inventory of available homes for sale compared to the high demand from buyers. With properties moving swiftly and often receiving multiple offers, sellers have the advantage of commanding higher prices and favorable terms. However, buyers may face challenges such as limited options and potential bidding wars, making it crucial for them to act quickly and decisively.

As of the latest data available, there is no indication of home prices dropping in the New Hampshire housing market. On the contrary, home values have been steadily increasing, reflecting strong demand and limited inventory. Factors such as low mortgage rates, population growth, and a robust economy contribute to the upward trajectory of home prices. While market conditions can fluctuate over time, there is currently no evidence to suggest a significant downturn in home prices.

While predictions about the future of the housing market are inherently uncertain, there are no immediate signs indicating an impending crash in the New Hampshire housing market. The market has shown resilience in the face of various economic challenges and continues to exhibit stability and growth. However, it's essential to monitor factors such as interest rates, employment trends, and housing affordability, as they can influence market dynamics. Overall, while no market is immune to fluctuations, there is currently no evidence to suggest an imminent housing market crash in New Hampshire.

For prospective homebuyers, determining whether now is a good time to buy a house depends on various factors, including personal circumstances, financial readiness, and market conditions. While the New Hampshire housing market presents challenges such as high demand and limited inventory, it also offers opportunities for those who are prepared to act decisively.

With low mortgage rates as compared to last year and the potential for future appreciation in home values, many buyers may find it advantageous to enter the market sooner rather than later. However, individuals should carefully assess their financial situation and long-term housing needs before making a decision.

In Manchester, NH, a metropolitan statistical area (MSA), the forecast indicates steady growth in home values. From the base date of February 29, 2024, to March 31, 2024, the projected increase is 0.6%. This growth trajectory is expected to continue, with forecasts showing a rise to 1.7% by May 31, 2024, and further to 3.2% by February 28, 2025. Such consistent growth suggests a robust and potentially competitive market in Manchester, NH, with opportunities for both buyers and sellers.

Similar to Manchester, the housing market in Concord, NH, is also forecasted to experience steady growth in home values. From February 29, 2024, to March 31, 2024, the projected increase stands at 0.6%, with further growth expected to reach 1.6% by May 31, 2024, and 3.7% by February 28, 2025. These projections indicate a positive outlook for the housing market in Concord, NH, presenting opportunities for investment and growth.

Keene, NH, presents another interesting case within the state's housing market. While starting from a slightly lower base, the forecast still points to consistent growth in home values over the forecast period. From February 29, 2024, to March 31, 2024, the projected increase is 0.3%, with further growth anticipated to reach 1.4% by May 31, 2024, and 3.9% by February 28, 2025. This indicates that Keene, NH, remains an area of potential opportunity for those looking to enter or expand their presence in the local real estate market.

In Laconia, NH, the housing market forecast suggests moderate growth in home values, albeit at a slightly slower pace compared to other regions. From February 29, 2024, to March 31, 2024, the projected increase is 0.2%, with growth expected to reach 0.9% by May 31, 2024, and 3.9% by February 28, 2025. While the growth rate may be more gradual, Laconia, NH, still presents opportunities for buyers and sellers seeking stability and potential appreciation in property values.

Finally, in Berlin, NH, the housing market forecast indicates a slightly slower initial growth rate compared to other regions. From February 29, 2024, to March 31, 2024, the projected increase is 0.1%, with growth expected to reach 1.1% by May 31, 2024, and 4.2% by February 28, 2025. Despite starting from a lower base, these projections still suggest a positive outlook for the housing market in Berlin, NH, with opportunities for growth and investment over the forecast period.

Overall, the regional housing market forecast for various areas in New Hampshire reflects a mix of steady growth and moderate appreciation in home values. Understanding these forecasts can empower individuals to make informed decisions tailored to their specific circumstances, whether they are buying, selling, or investing in real estate within these regions.

Sources: