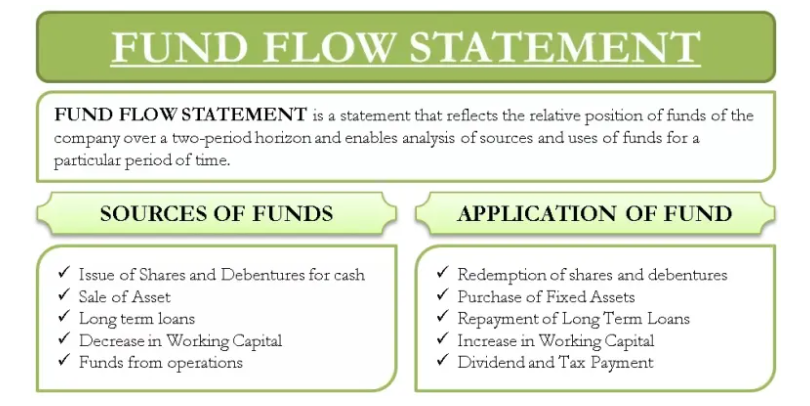

A fund flow refers to the inflow and outflow of funds or assets for a company and is often measured on a monthly or quarterly basis. A fund flow statement reveals the reasons for these changes or anomalies in the financial position of a company between two balance sheets. These statements portray the flow of funds - or the sources and applications of funds over a particular period.

Be prepared for upcoming challenges and learn how to manage your changing payments business today with our guide.

Fund flow statements are used to show movement and activity related to both long-term and short-term funds by revealing:

A company's financial statements already include a profit and loss statement and a balance sheet. So why is a fund flow statement needed at all?

In the area of financial management, there are 4 main financial statements from which to obtain financial data related to business operations.

1. Balance Sheet Accounts

2. Profit and loss Account

3. Cash Flow Statement

4. Fund Flow Statement

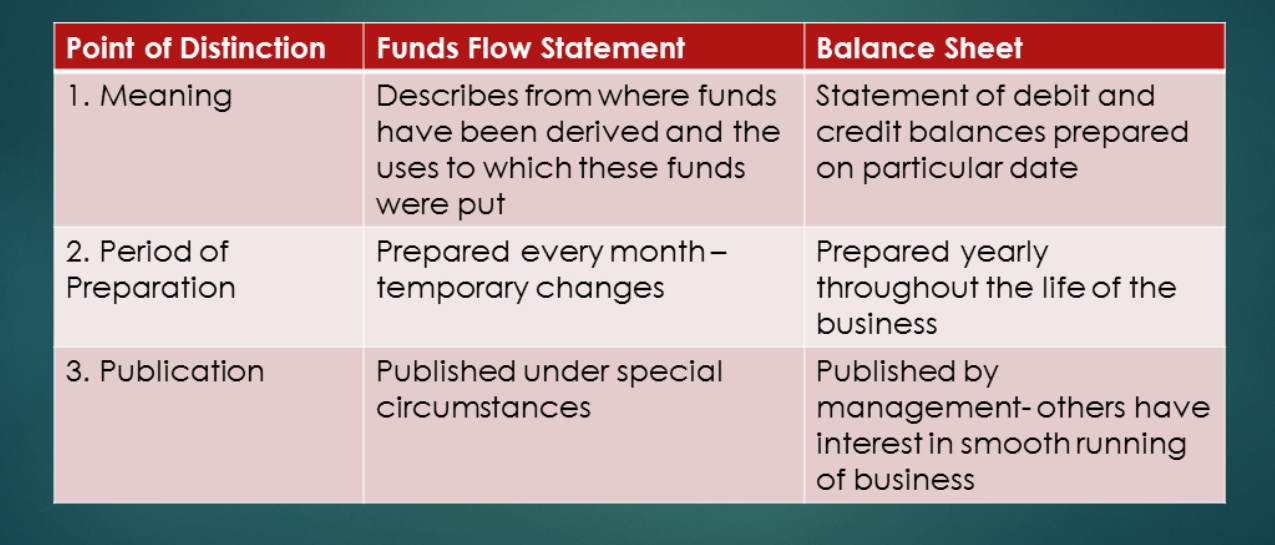

A company's balance sheet and income statement measures one aspect of performance of the business over a period of time.

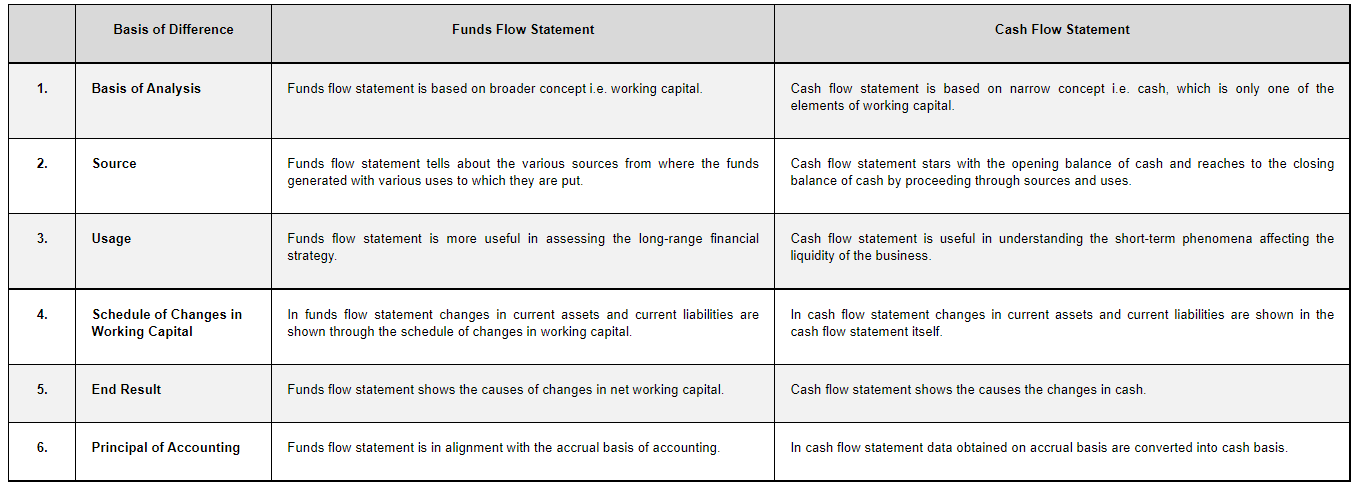

A cash flow statement shows the cash flows and cash equivalents of the business during business operations in one time period. A cash flow statement helps companies manage cash inflows (cash receipts), cash outflows (cash disbursements), operating cash flow. It shows

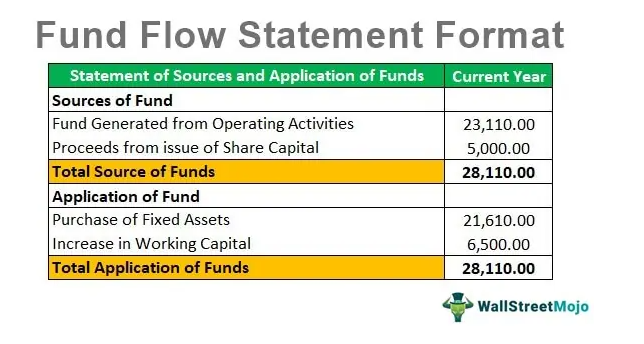

A Funds flow statement reports changes in a business's net working capital from its operations in a single time period. The main components of working capital are:

Current Assets

Current Liabilities

Net working capital is the total change in the business's working capital, calculated as total change in current assets minus total change in current liabilities.

For example: If the inventory of a business increased from $700,000 to $750,000, then this increase of $50,000 is the increase in the working capital for the corresponding period and will be mentioned on the funds flow statement. But the same would not be reflected in the cash flow statement as it does not involve cash.

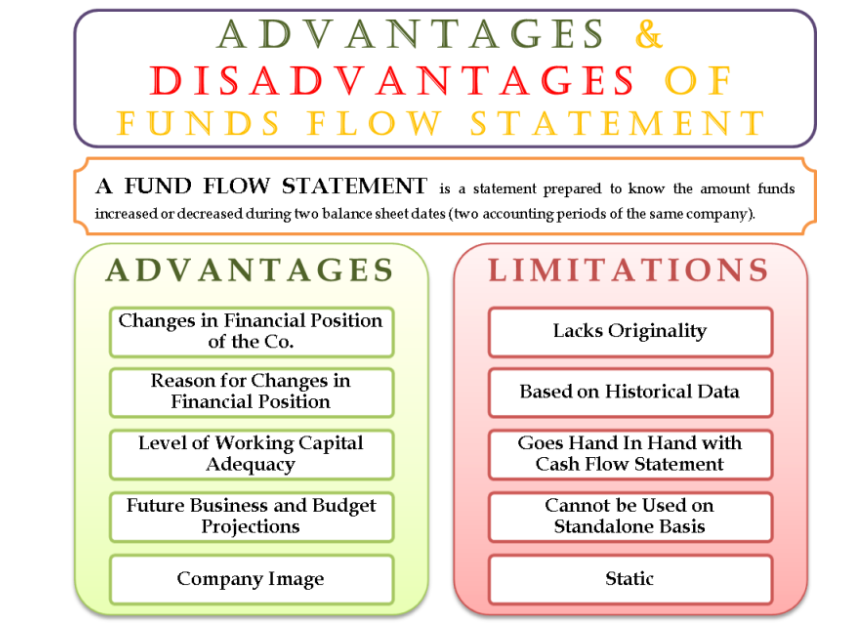

A funds flow statement is an essential factor in revealing how funds are used. A fund flow statement shows financial analysts how to assess the fund flow of an organization in the near future.

Usually, the preparation of these statements is followed by a funds flow statement analysis. It serves as a financial parameter that helps a company to control its finance and develop a better strategy for long term financial planning, and to utilize short term and long term funds.

Fund flow statement analysis is a comparison between various aspects of a Balance Sheet. While evaluating this statement, it is also vital to understand all the aspects.

If the asset section of a balance sheet experiences growth, it implies that the company has purchased assets by spending funds. These assets might then result in the inflow of funds in the future. Here are some examples:

On the other hand, if the assets section shows a decline, it means that the company has sold some of its assets to maintain fund inflow.

In a Funds Flow Statement, any increase in liabilities means the organization has funds inflow which needs to be paid. Some of the examples are:

Conversely, a decline in liabilities implies that the current obligations have been satisfied.

To remain financially sound, part of every company's accounting process should be to frequently analyze its fund flow statement (and other financial statements) to make appropriate business decisions.

Fund flow statements, along with profit and loss account statements and balance sheets portray the company’s present financial position when approaching banks, investors etc. for working capital funds and loans. Today, most businesses use advanced technology for accounting to draw up these complicated financial statements instantly.

This situation arises when the net working capital of a business has experienced an increase in current assets. This can be defined by increased receives or other assets, or a decrease in current liabilities.

This indicates a company's liquidity position, showing that funds can now be used effectively by the company to meet changes in working capital requirements, pay its dividends or pay off some of its short term outstanding loans etc., from its long-term sources. Such a company is financially healthy and a good bet for its capital investors.

This situation comes about when the company has fewer long-term sources of funds, and an increase in the application of funds. In these circumstances, a company may need to raise a loan to meet its commitments.

It's crucial for fund managers to have a deep understanding of the company’s funds flow statement, and investor input, as it reflects changes in sources of capital and fund utilization purposes. The excess or deficit in a company’s current liabilities and assets can only be effectively viewed and scrutinized in the funds flow financial statement rather than the income statement or balance sheet.

A fund flow statement will also reveal information about a company's fixed and current assets.

Noncurrent - or fixed assets are a company's long-term investments for which the full value will not be realized within the accounting year. Examples of noncurrent assets include investments in other companies, patents, property, plant and equipment.

So, a company using its long term funds flow for fixed assets is generally regarded as the right utilization of funds and these details are revealed a by fund flow statement.

Current assets are any assets that can be converted into cash within a period of one year.

This counts products that are sold for cash as well as resources that are consumed, used, or exhausted through regular business activities that are expected to provide a cash value return within a single accounting period.

This is not an ideal situation, and indicates that a company could find itself in a cash-crunch situation. Once an investment is made into long-term assets using short-term funds, the company will not be in a position to quickly convert those assets into liquid cash due to the nature of the investment. This could seriously affect its ability to repay short-term obligations.

A funds flow statement helps explain the source of funds and its utilization or application, allowing the users of financial information to interpret and know the impact on the business.

Free cash flows (FCF) refer to how much cash a company generates after allowing for cash outflow to support operations and maintain its capital assets. Unlike earnings or net income, free cash flow is a measure of profitability that excludes the non-cash expenses of the income statement and includes spending on equipment and assets - as well as changes in working capital from the company balance sheets.

Net present value (NPV) refers to the difference between the present value of cash inflows and the present value of cash outflows over a period of time. NPV is used in capital budgeting and investment planning to analyze the profitability of a projected investment or project.

1. Shows financial position. A funds flow statement helps indicate the addition in profits, which is a boon to shareholders.

2. Indicates addition of share capital. The fund flow statement can highlight changes in share capital.

3. Shows addition or reduction in share premium. The fund flow statement shows fluctuations in share premiums. This increases when shares are issued at premium or when preferential shares or debentures are reduced and the funds flow statement shows key information at a glance.

4. Reveals profit or loss of operation. The fund flow statement clearly shows whether an organization is earning profit or sustaining a loss.

5. Reveals addition in long-term borrowings. The statement can show the additional amount borrowed by issuing debentures.

6. Indicates decrease in working capital. The statement shows the reduction in working capital (i.e., when current assets are less than current liabilities).

7. Fund flow statement acts as a guide. The statement allows management to learn about future problems, needs, and fundraising requirements, helping the company to avoid financial problems.

8. Helpful in sound dividend policy. Sometimes, a company may have sufficient profit, yet it is advisable not to distribute dividends due to lack of cash or liquidity. The fund flow statement is useful in informing sound dividend policy.

9. Helpful in long-term borrowings. Before advancing long-term loans, lenders may ask for several years of fund flow statements to learn the firm’s creditworthiness.

10. Useful information for investors. Before investing, some investors study a company’s fund flow statements to know how funds are raised and used (e.g., whether funds are adequate for the payment of interest and principal sum).

Through valuable data insights, led by information and payments data, a business can improve profitability, optimize revenue and cut costs. Properly analyzed data gives clear visibility into an organization's financial situation. In a payments environment, transaction monitoring identifies performance issues, and detects fraud and other anomalies.

Payment analytics tools allow a business to take historical data and apply it to things that are happening to a business right now, creating cash flow visibility.

Performance management through analytics is important to any business with a financial department. Every business needs to be able to see their cash flow and have the means to control it.

IR Transact simplifies the complexity of managing modern payments ecosystems, bringing real-time visibility and access to your payments system. Transact gives organizations unparalleled insights into transactions and trends to help turn data into intelligence, and assuring the payments that keep you cash flow positive.

With dynamic visualization tools, businesses easily get a clear view of all this information to make proactive management decisions. Transact offers a thousand points of reference, from a single point of view.