If you are disabled from working, you may well be depending on receiving long-term disability benefits through a policy provided by your employer. Knowing the right steps and timeframe in which to apply for long term disability benefits (LTD benefits) can make all the difference in being approved for benefits when you need them most.

Depending on the policy, long-term disability insurance pays a percentage of your salary, typically 50 to 60 percent. The benefits last until you go back to work or for the maximum number of the years stated in the policy (either limited by the policy or near your retirement age).

It is very important to understand that LTD benefits usually require a separate application from short-term disability benefits. If your policy provides for short-term benefits, these will usually last for only 1-6 months — exactly how long they are available depends on the particular policy. If you continue to be disabled and unable to work after your short-term benefits expire, you usually need to apply separately for long-term disability benefits.

Table of Contents

Apply for Long Term Disability Benefits in 7 Simple Steps

5 days

If you become disabled and are unable to work for a period of time or indefinitely, it is important to carefully review your long-term disability insurance policy options. If you have a private LTD policy, your policy documents will explain the process for applying for benefits.

Your policy will generally define what it considers a “disability,” as well as what does not count as a disability for purposes of receiving benefits. For example, many policies do not cover inability to work due to substance abuse or pre-existing conditions. Further, benefits may be time-limited if your disability relates to a mental health condition — like depression — or to “subjective” conditions that are hard to measure or document with conclusive medical tests, such as fibromyalgia, chronic fatigue syndrome or migraine headaches.

Your employer’s Human Resources department can be an invaluable resource throughout the application process. Someone in your HR department should be able to provide you with an LTD application and important instructions to complete it.

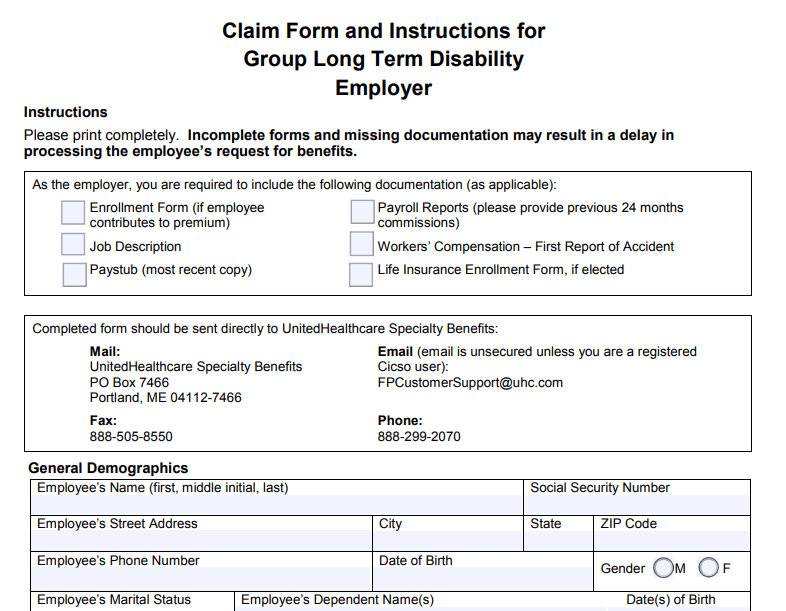

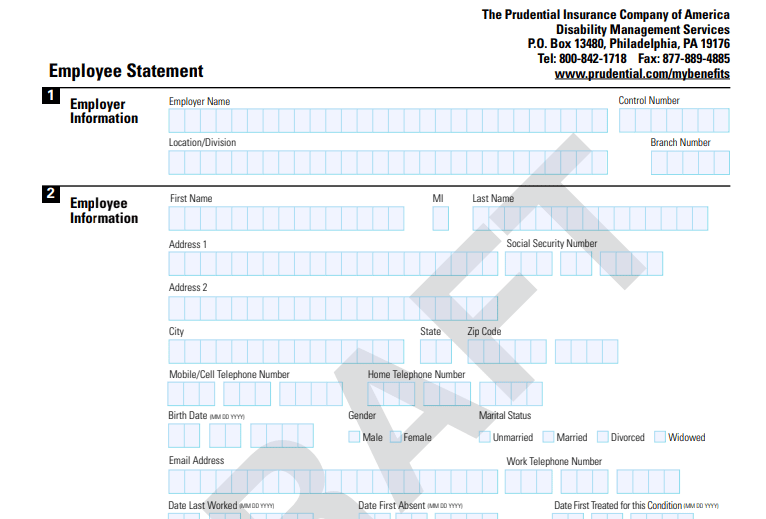

You may also be able to find the forms on the insurance company or claim administrator’s website. The following are examples of long term disability claim forms taken directly from insurance companies’ websites:

Humana Disability Claim Form

Prudential LTD Claim Form

Cigna Long Term Disability Application

United Healthcare LTD Disability Benefits Claim Packet

You will be responsible for completing a section of the LTD application often referred to as the Employee’s Statement. It will generally require you to provide information such as:

– Your address and phone number

– The name of your employer

– Your occupation

– Your birthdate

– Your Social Security number

– Your work history

– Your educational background

– The date your were injured or your illness started

– The last day you worked

– A description of your disability

– The names and contact information for your doctors/medical providers

– Any medications you take

– Any other income you may be eligible to apply for

It is important to answer every question completely. However, the form may limit the space available to respond, so use an additional page if necessary to give full and complete answers.

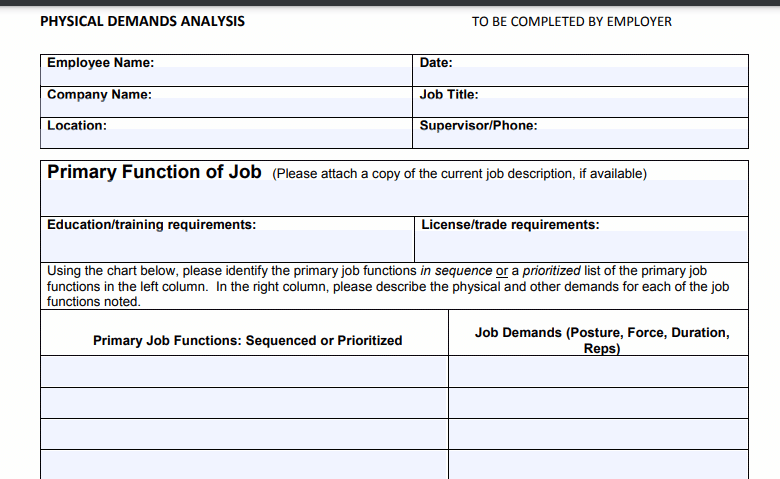

The LTD application will also require your employer to provide certain information. Such information could include your hire date, job description, salary, the physical and psychological requirements of your job, the date insurance coverage became effective, last day worked, and the date you returned to work (if applicable).

It is important to see a doctor prior to applying for long-term disability benefits since the insurance company will require medical proof of your disability. You may have to submit a signed authorization that allows the insurance company or administrator to request your medical records. Your signature will let the insurance company get the information about you that they need to determine your eligibility for benefits.

Additionally, as part of your LTD application, your doctor will be asked to complete a form or write a statement regarding his or her opinion of your condition. This may include information about dates of treatment, symptoms, findings, diagnoses, determination of whether your injury or illness is work related, types of treatment, opinions about your current limitations and when you may return to work, and any other information that the physician deems pertinent. If your doctor is not supportive of your claim, it may be very difficult for you to prove your disability and qualify for benefits. It is a good idea to speak with your doctor prior to starting your application so you can be sure he or she supports you.

To show that your disability is ongoing, you should continue to receive treatment from your doctor while your LTD claim is pending, even after you are approved for benefits. Failure to continue treatment could be grounds for the insurance company to terminate your benefits.

If your LTD claim has been granted, most policies will require you to file for Social Security disability benefits as well. Any Social Security benefits you receive will offset the amount the LTD insurance company is required to pay. Thus, your LTD insurance company has a significant interest in seeing you approved for Social Security benefits. Because of this interest, the insurer may refer you to a national company to assist you with your Social Security application. It is important to remember that these companies are focused primarily on saving the insurance company money. They may not be attorneys, and may not put your interests first. Bross & Frankel can assist you with your Social Security disability application. Call (856) 795-8880 today to learn more.

LTD claims can be complicated and are often denied for all sorts of reasons. For this reason, many disabled workers choose to work with an attorney right away to get help with the LTD application process. An experienced LTD benefits attorney can help you increase the chances that your LTD benefits will be approved by ensuring that you do everything right with your application, including submitting the most complete evidence of your disability.

If your application for LTD benefits has been denied and you want to appeal the denial, it is important you act quickly and follow each required step for an appeal — which generally includes contesting the denial in writing to the insurance company and, if you need to sue in court, meeting strict filing deadlines. An attorney is especially helpful during the appeal process.

If the disability application process has you at your wits’ end or your claim LTD benefits has been denied, contact or call the experienced and skillful disability attorneys at Bross & Frankel today at 856-795-8880 for a free consultation.

Rich Frankel is the managing partner of Bross & Frankel. He is a member of the New Jersey and Pennsylvania bars. He has focused exclusively on disability and social security benefits since 2005.

Mr. Frankel joined what is now Bross & Frankel after having watched his father struggle with disability, fighting a lengthy illness. Mr. Frankel founded the firm’s veteran’s law practice and substantially grew the social security disability practice, focusing Bross & Frankel’s ability to fight for all of the disability benefits available to his clients.

Mr. Frankel additionally fights for clients in court, obtaining frequent victories in Social Security appeals and against insurance companies in Federal court.